Exploring Tulip Mania

The Tulip Mania of the 17th century in the Netherlands persists as an enigmatic chapter in financial history, characterized by a fervent obsession with tulip bulbs that escalated into a speculative frenzy of unprecedented proportions, often considered the first speculative bubble. Against the backdrop of the Dutch Golden Age, marked by economic prosperity and cultural flourishing, the saga of Tulip Mania unfolds as a complex interplay of socio-economic dynamics and speculative behavior. This research article aspires to dissect the phenomenon of Tulip Mania, examining its origins, the socio-economic landscape of the Dutch Republic, the mechanisms of tulip speculation, modern reinterpretations of the event, and its enduring significance.

Netherlands Economy at the 17th Century

In the 17th century, the Dutch Republic emerged as a formidable economic powerhouse, propelled by thriving trade routes facilitated by the Dutch East India Company. The Netherlands enjoyed unparalleled wealth and prosperity, powered by commercial ventures that span the world. Amsterdam, in particular, emerged as a bustling hub of finance and commerce, attracting merchants and investors from across Europe. The city’s stock exchange, established in 1602, facilitated the trading of shares in various enterprises, further fuelling economic growth.

Moreover, the Dutch were pioneers in industries such as shipbuilding, textiles, and banking, fostering innovation and entrepreneurship. Their mastery of water management and land reclamation enabled the cultivation of vast agricultural lands, enhancing food production and bolstering the economy.

The Dutch Golden Age, as it came to be known, was characterized not only by economic prosperity but also by the flourishing of arts, sciences, and philosophy. The patronage of wealthy merchants and civic leaders fuelled a cultural renaissance, producing masterpieces by renowned painters like Rembrandt and Vermeer.

Tulip Mania: Insights and Analysis

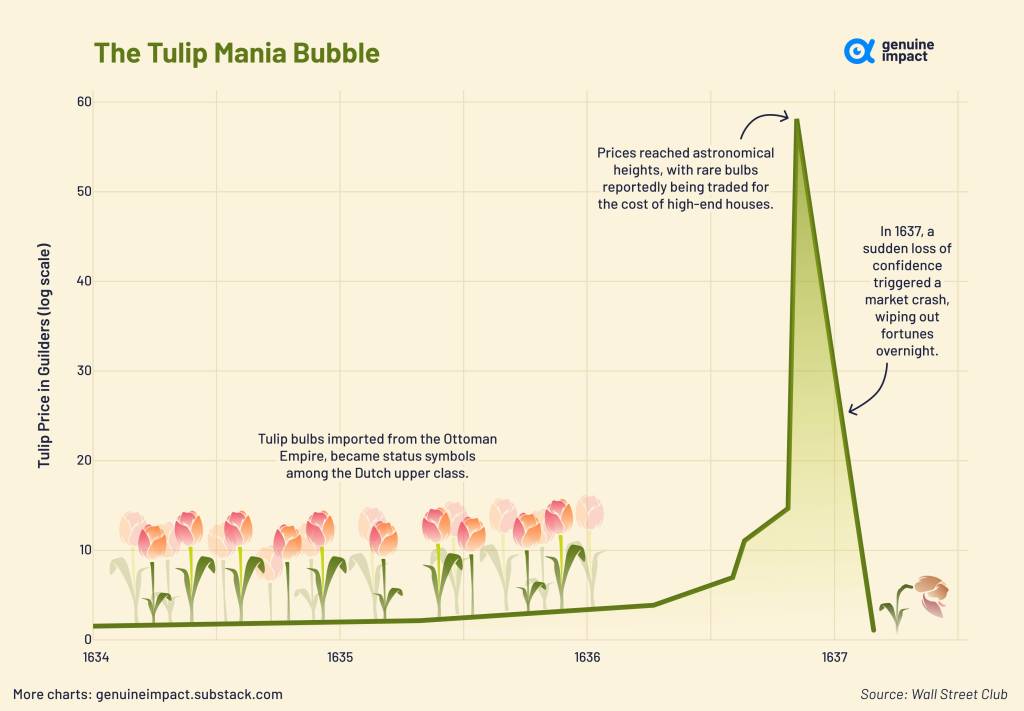

The phenomenon of Tulip Mania traces its origins to the introduction of tulip bulbs from the Ottoman Empire to the Dutch Republic during the early 17th century. These bulbs, admired for their rich colors and intricate designs, were initially seen as exotic novelties. However, their fascination quickly spread among the Dutch upper class, igniting a growing fascination.

Picture 1: Tulips in Netherlands

What began as a mere curiosity for rare tulip varieties gradually transformed into a thriving speculative market. The escalating demand for these bulbs, coupled with the introduction of innovative trading methods such as futures contracts and options, contributed to the rapid expansion of tulip speculation. This combination of factors led to a frenzy of buying and selling, driving prices to unprecedented heights, and ultimately culminating in the infamous Tulip Mania.

By 1636, speculative fervor surrounding tulip bulbs had reached fever pitch, driven by a combination of factors including the novelty of tulips, their limited supply, and the allure of potential profits. Traders, both seasoned investors and novices alike, became increasingly caught up in the excitement, fuelling a frenzy of buying and selling.

The introduction of futures contracts revolutionized the tulip market, enabling traders to speculate on the future value of bulbs that had not yet bloomed. This innovation not only expanded the scope of tulip trading but also intensified speculation, as traders leveraged their positions in the hope of securing substantial profits.

Prices surged to unprecedented levels, with some rare tulip bulbs fetching exorbitant sums that far exceeded the value of even the most prestigious real estate properties. The rapid escalation of prices only served to attract more participants to the market, including individuals from all levels of society who were enticed by the prospect of quick riches.

However, the euphoria of Tulip Mania was short-lived. In February 1637, the market sentiment abruptly shifted, triggering a sudden and catastrophic collapse in tulip prices. This loss of confidence is believed to have been fuelled by various factors, including concerns about the sustainability of the speculative bubble and a realization of the inflated nature of tulip prices.

Graph 1: The Evolution of Tulip Price (Source: Genuine Impact)

The collapse of the tulip market served as a sobering lesson about the dangers of speculative excess and the inherent instability of asset bubbles. Nevertheless, Tulip Mania remains a compelling case study in financial history, offering valuable insights into the dynamics of speculative markets and the psychology of investor behaviour.

Tulip Mania: Contemporary Perspectives

Recent research has offered compelling challenges to conventional narratives surrounding Tulip Mania, providing nuanced insights into the socio-economic realities of the period. Anne Goldgar’s meticulous examination, in particular, has reshaped our understanding of Tulip Mania, emphasizing the limited scope of the speculative frenzy and its relatively contained economic repercussions.

Contrary to sensationalized portrayals of widespread financial ruin, Goldgar’s analysis suggests that Tulip Mania primarily affected a small segment of Dutch society. The resilience of the Dutch economy and the absence of widespread bankruptcy among speculators challenge simplistic interpretations of Tulip Mania as an economic catastrophe.

Picture 2: Anne Goldgar (historian specialized in seventeenth and eighteenth-century European history)

Furthermore, modern economists propose alternative explanations for the fluctuations in tulip prices. One aspect that economists highlight is the role of geopolitical events in influencing tulip prices. The Dutch Republic was a major player in international trade during the 17th century, and fluctuations in political relations with other countries could have ripple effects on the tulip market. For example, conflicts or alliances with tulip-producing regions could impact the supply chain, leading to price fluctuations.

Additionally, economists emphasize the natural volatility inherent in markets, especially those dealing with novel or exotic goods like tulips. The tulip trade was still relatively new during Tulip Mania, and market participants were navigating uncharted territory. As a result, price swings could occur due to factors such as changes in consumer preferences, variations in weather affecting bulb growth, or shifts in demand from domestic or international buyers.

By re-evaluating the historical context and economic realities of Tulip Mania, recent research prompts a more nuanced understanding of this episode in financial history, offering valuable insights into the complexities of Dutch economic expansion and cultural development during the 17th century.

Conclusion

The Dutch Tulip Mania of the 17th century serves as a cautionary tale about excessive speculation and societal fascination. Against a backdrop of economic prosperity and cultural refinement, tulip bulbs became incredibly popular in Dutch society, leading to an unprecedented speculative frenzy. However, the subsequent market crash showed how fragile speculative bubbles can be, highlighting the importance of being cautious and rational in financial decision-making.

Anne Goldgar’s research has provided valuable insights into Tulip Mania, revealing that it primarily affected a small segment of Dutch society, challenging the notion of widespread financial ruin. Economists also suggest that geopolitical events and market volatility played significant roles in the rise and fall of tulip prices, emphasizing the complexities of market dynamics. Despite occurring centuries ago, Tulip Mania remains relevant today, serving as a reminder to approach financial markets with prudence and awareness of the risks associated with speculative behavior.

Sources: History, Amsterdam Tulip Museum, Genuine Impact

Beatriz Gomes