Financial literacy springs as a cornerstone of responsible and efficient financial management and entails one’s capacity to comprehend financial concepts to make informed decisions regarding money, budgeting and investment.

Typical household activities like going to the supermarket for monthly shopping. This simple action encompasses numerous integral financial concepts, such as budgeting, basic asset pricing, and price variation, that is, inflation. In accordance with the ubiquity of such concepts in one’s everyday life, statistics conducted amid the Plano Nacional de Formação Financeira for “Todos Contam”, show that around 81% of Portuguese respondents evidence concern about household budgeting and personal finances. However, despite its relevance, many individuals still struggle with basic concepts, such as inflation, as more than one in three people in the EU do not understand how inflation erodes their purchasing power.

Why is it important?

As introduced, financial concepts are ever-present in daily lives as these serve as a safeguard against excessive borrowing, unforeseen expenses, and foster conscious financial planning and stability. Financial literacy is a fundamental competency for families to sustainably improve well-being and quality of life, even more so when assessing the current inflation rate variations and, consequently, increased interest rates and decreased household purchasing power.

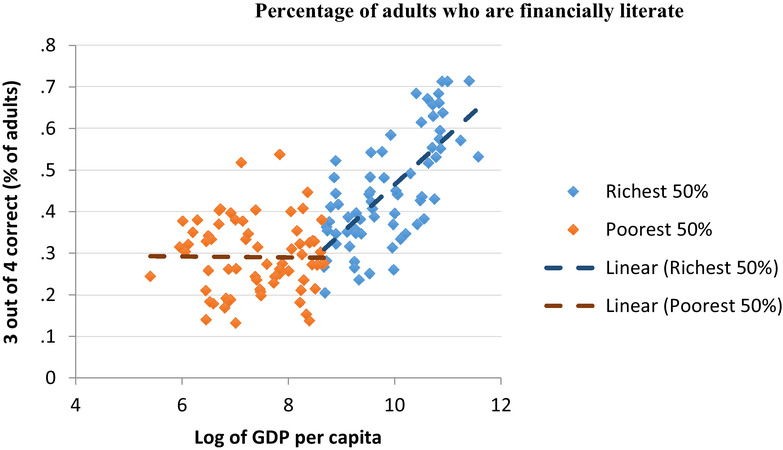

A solid understanding of concepts such as the link between interest rates and bond prices, asset diversification, and time value of money, is associated with improved management of household savings and investments. Conducted studies show that households which hold more financial knowledge have greater tendencies to, for instance, allocate resources more efficiently, plan retirement savings, and contain debt (Demertzis at al. 2024). This relationship raises the question of whether wealth derives from general financial literacy or the opposite. Well, by using GDP per capita as a proxy for income, a positive relation between income and financial literacy is displayed among the richest 50% countries and around 48% of the variation in financial literacy rates can be explained by differences in income across countries (Kapper et al. 2024). However, the same is not evidenced in the poorer half of countries, where a correlation is not shown.

Source: S&P Global FinLit Survey and World Bank–World Development Indicators (http://data.worldbank.org)

Furthermore, as the world experiences a rapid technological development, digital literacy also plays a role in financial decisions being made, as overwhelming amount of information is progressively more accessible for the public. This heightens the risks of navigating the digital financial landscape and further increases the vulnerability of less informed groups, including the youth and elderly. As Eurostat’s data reveals that, in 2022, the average age at which young people left their parents’ home was 26.4 years. Coupled with this, in recent years, there has been a striking surge in the promotion of young individuals accounting for their own financial decisions, with the 3rd conducted inquiry on Portuguese Literacy, for Plano Nacional de Formação Financeira in 2020, indicating a significant increase, from 20% in 2015 to around 45% in 2020 of people ranging from 18 to 24 years old. This emerging trend suggesting that younger generations are assuming financial decisions progressively earlier, further emphasizes the importance of financial literacy, and the fundamental impact its lack of could have in these generations’ life.

Financial Knowledge in Portugal

Financial literacy not only encompasses knowledge, but also practices in accordance. In Portugal, financial literacy stages a rather complex picture since, while efforts are being developed to improve literacy, challenges impose themselves which foment the need for more comprehensive educational initiatives. These, for example, include Portugal’s position in financial literacy as 26th in 2023’s Eurobarometer, surpassing only Romania. Despite this lagging position in performance, Portugal is 13th in OCDE/INFE’s inquiring (out of 39 countries), 7th regarding financial attitudes and habits and 21st in terms of financial knowledge. The latter explains an existing deficit financial literacy when it comes to financial numeracy, computation of compound interest and the importance of asset diversification. Additionally, as formerly tackled, the digital age has brought its own set of challenges, namely regarding information overload and unfiltered misinformation, from which Portugal is no exception.

Addressing these challenges requires a multifaced approach whereby financial concepts should not only be taught but applied effectively as well. Despite Portugal’s lack of literacy, there is still optimism in initiatives such as “Digital Financial Literacy Strategy for Portugal”, designed with support from the OECD and the European Commission, bringing about meaningful change, by providing low-income families, middle-aged individuals and young adults crucial skills and fundamentals to enhance their quality of life and financial health.

Financial Knowledge in the European Union

More than a decade ago, indicators of financial literacy established low financial knowledge among a large world share, even in countries with well-developed financial markets, such as European Union (EU) countries (Lusardi and Mitchell 2011 cited in Demertzis et al. 2024). However, the will of refining financial literacy has rose globally.

In 2021, the European Commission (EC) carried out a survey that aimed to access the level of financial knowledge of the EU population. Demertzis et al. 2024 show that, on average, just over 50 percent of the respondents answered correctly to at least three of the five knowledge questions, suggesting that financial knowledge continues to be low despite the increased interest in it. Particularly, only one in five respondents correctly answered questions regarding the relationship between interest rates and bond prices, on average. In this context, it is also relevant to state the presence of a gender gap in financial knowledge, such that more men than woman answer at least three out of five questions correctly, with 18 percentage points of difference, on average in the European Union. This study also assesses that more financial knowledge is linked to higher financial inclusion, as EU countries with higher levels of financial knowledge have greater percentages of adults saving with and borrowing from financial institutions.

Bruegel based on European Commission (2023a)

Over-Indebtedness: Private, Public, Global

Most commonly, over-indebtedness refers to the situation in which the monthly earnings of a family are not enough to contemplate both essential expenses and the credit instalments, implying a lack of space for savings. In such a situation, it is said that families face a high debt burden. Besides the obvious hazards of excessive debt, that are translated into reduced living standards, it can be detrimental to the mental health of individuals, thus affecting personal relationships and stimulating isolation. According to experts, here, the role of financial literacy becomes particularly evident, not only as a prevention mechanism, but also as a key first step into debt-freedom.

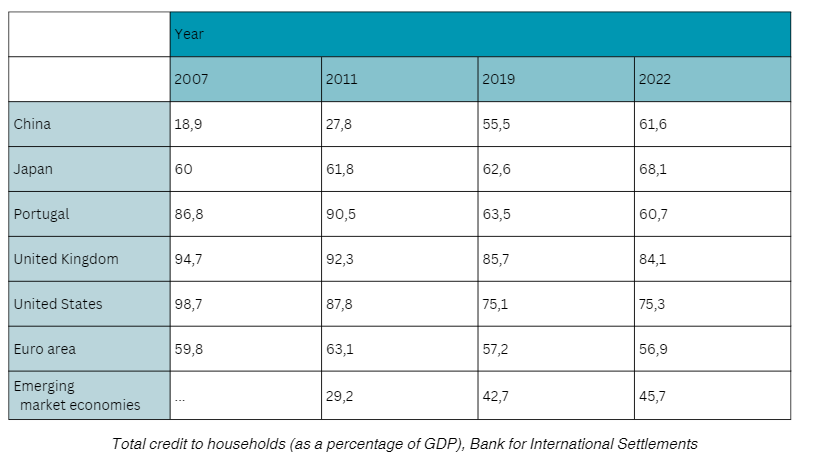

According to the OECD database, household debt (all liabilities of households that require payments of interest or principal by households to creditors, as a percentage of net household disposable income) has been registering a negative trend in Portugal since 2011, despite a slight increase in 2020 at the hand of the global pandemics. Total credit to households as a percentage of GDP as also been diminishing since the period around the Sovereign Debt Crisis, with Portugal foll owing the EU area movement. On the other hand, emerging economies have been registering a great increase in the credit to households.

Household debt, OECD

Excessive amount of private debt is not only a concern for individuals, but also for the whole economy. There is evidence that private “credit booms” many times culminate in either financial crisis or economic underperformance (Dell’Ariccia et al. 2012). Until the Great Recession in 2008, policy paid limited attention to the situation. The economic intuition for the question of underperformance is that when private debt is high, agents divert a large portion of their income to the payment of interest and principal on that debt, ending up spending and investing less. High debt can make borrowers more reluctant to spend or take on more debt. Additionally, there is research that establishes a link between private and public debt, such that the excess of the first systematically turns into more of the second, regardless of whether the credit boom resulted in a crisis or a more orderly deleveraging process (Mbaye et al. 2018).

“Finanças Para Todos”

With the conviction that university poses a fundamental role in providing services to the civil society, “Finanças Para Todos” comes as free training program on the subject of financial literacy, with a particular focus on low income and lower education individuals. Throughout five enlightening sessions, diversified speakers cover subjects that go from family budget to investment and retirement. Created with the contribute of Nova SBE Finance Knowledge Center, “Finanças Para Todos” has now registered around eleven thousand applications, with its second edition counting with more than two thousand online participants and almost than five hundred on a presential regime (on the Nova SBE campus).

Additionally, there are many online resources available, from articles to videos or even interviews, always keeping in mind the ever-present goal of raising awareness to the subject of financial literacy while demystifying finance theory and enhancing the importance of conscious and informed decision-making.

The Nova Awareness Club was very pleased to have joined two sessions, so as to get a better grasp on the intricacies of each session, the dynamics of the program and the strong class interaction, as well as extend our financial education, that many times lacks a more practical component.

To conclude, as economic landscapes evolve, promoting a financially literate population becomes increasingly imperative as it paves the way for prosperity and financial security among families.

From the supermarket aisles to the corridors of academic institutions, the impact of financial literacy acutely resonates not only with households’ lifestyles, but with the broader economic landscape. As the world navigates the complexities of private and public debt, digital footprint and global economic trends, the need for further investment on financial literacy across countries grows progressively evident to ensure a financially sustainable future.

Maria Francisca Pereira

Madalena Rosário