INTRODUCTION

The debut of a company on the stock market through an Initial Public Offering (IPO) is a momentous occasion that captivates the attention of investors, business enthusiasts, and the wider public. The excitement surrounding an IPO is palpable, driven by a convergence of factors that elevate it beyond mere financial transactions to a symbol of innovation, growth, and opportunity. From the allure of exclusive investment opportunities to the potential for substantial returns, and from media attention to the economic impact and innovation potential of newly public companies, the commotion of an IPO transcends traditional market dynamics to embody the spirit of entrepreneurialism. All aspiring companies want to be the next Saudi Aramco or Alibaba, however, this time, we will take a deeper look at Reddit. Was the buzz worth the hype?

A BRIEF HISTORY OF REDDIT

First and foremost, Reddit operates as a platform where registered members can submit content, such as text posts or direct links, and engage in discussions through comments. The content is organized into “subreddits,” which cover a wide range of topics, from niche hobbies to global news. What sets Reddit apart is its emphasis on user-generated content, fostering a sense of belonging and authenticity among its users.

In 2005, Reddit was created by two programmers from Virginia University, Steve Huffman and Alexis Ohanian, in the aftermath of attending a lecture by programmer-entrepreneur Paul Graham, leading to Huffman taking charge of coding the site, using Common Lisp, and launching Reddit in June of that year. As the platform gained traction, Christopher Slowe was welcomed onboard and eventually merged with Aaron Swartz’s company, Infogami. Swartz played a crucial role in revamping Reddit’s software by implementing his web framework, web.py, thus leaving a lasting mark on Reddit’s technical evolution and the broader web development community.

The following year, Reddit was swiftly acquired by Condé Nast Publications for a raging sum ranging from $10 million to $20 million, thus, prompting the team to relocate to San Francisco. Afterward, both Huffman and Ohanian departed Reddit’s helm in 2009. Since then, Reddit gained operational independence from Condé Nast in 2011 and many years as well as CEOs later, the original co-founder, Huffman, returned as the Chief Executive Officer.

REDDIT’S REVENUE SOURCES

Reddit earns money primarily through advertising, premium memberships, and partnerships.

When it comes to advertising, Reddit has a unique system that allows advertisers to target specific subreddits or communities, making it attractive for those aiming to reach niche audiences. These offer both managed and self-serve ad options, with prices varying based on the audience targeted. In recent years, Reddit’s ad revenue has seen significant growth, with increasing projections indicating substantial earnings: about $119 million in ad revenue in 2019, which skyrocketed the following year by 52.4%, to $181.3 million.

Reddit Gold, a premium membership, offers users extra features and benefits for a fee. This includes an ad-free experience and several other perks. The revenue from these memberships has been steadily increasing, showing that users are willing to pay for additional benefits. For example, in 2021, about 344,000 Reddit users brought in a staggering value of $17.21 million in revenue for the platform, considering that in 2020 it had only generated 12.38 million. Moreover, Reddit partners with other companies to provide sponsored content and promotional opportunities, thereby assisting the company in generating revenue while also offering value to its users.

THE IPO BUZZ: EXCITEMENT AND EXPECTATIONS

The IPO buzz can be traced back to 2021. However, one of the main reasons why this IPO gained so much attention was due to the introduction of AI.

Reddit disclosed its plans to allow third parties to access its data for purposes like training artificial intelligence models, as the company has already entered into data licensing agreements worth $203 million. From these agreements, Reddit anticipates earning at least $66.4 million in revenue this year.

Additionally, Reddit has partnered with Google, allowing Google’s AI products to utilize Reddit data to enhance their technology. This collaboration underscores the growing importance of original human-generated content, particularly, as AI-generated content becomes more prevalent on a day-to-day basis.

THE INITIAL IPO: TRIUMPHS AND CHALLENGES

On the morning of March 21, 2024, Reddit debuted on the stock market with the ticker symbol RDDT.

Reddit Inc.’s shares surged an astonishing 48% above their initial public offering price, which reflected the investors’ enthusiasm for the company’s futures secured around artificial intelligence. The San Francisco-based firm’s stock closed at $50.44 each on Thursday in New York, following a successful offering where the company and some of its shareholders raised $748 million, pricing it at the top end of the marketed range. Furthermore, Reddit’s IPO now stands as the fourth largest on a US exchange, demonstrating a revival in the market for initial public offerings after a two-year sluggish period. This successful listing is expected to encourage other tech companies that had delayed their plans to go public.

With a fully diluted valuation nearing $9.5 billion, Reddit falls just short of the $10 billion mark it achieved in a 2021 funding round. Analysts, including Mandeep Singh, senior industry analyst for Bloomberg Technology, had suggested even before pricing that Reddit could be valued at as much as $10 billion.

Reddit’s IPO pricing implied an enterprise value-to-sales multiples positioned between Meta Platforms Inc.’s higher multiples of eight times and the lower multiples of smaller digital advertising peers like Snap Inc. and Pinterest Inc., according to Singh. He emphasized that investors are willing to pay for growth, particularly given Reddit’s accelerated growth in the past six months, making a strong case for a premium valuation. Hence, it is worth mentioning that Reddit’s IPO surpasses notable listings in September by US tech firms Instacart and Klaviyo Inc., both of which raised substantial amounts.

THE FALL: UNFORESEEN OBSTACLES AND MARKET VOLATILITY

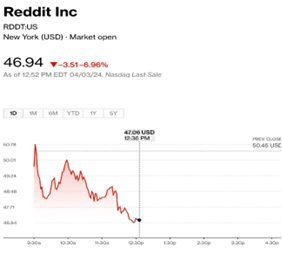

Following a report by Hedgeye Risk Management suggesting Reddit Inc.’s stock should decline by about 50%, Reddit shares experienced their largest one-day drop since their trading debut. The stock fell 11% on Wednesday, closing at $57.75 per share, its lowest since March 22. While Reddit shares had surged more than 90% since the IPO on March 21, Hedgeye deemed the stock “grossly overvalued” and recommended it trade closer to its IPO price of $34.

Reddit is set to report its first-quarter 2024 results in late May. While Hedgeye anticipates positive momentum in the first report, they caution potential weaknesses in future reports, particularly expecting a slowdown in user and revenue growth in the second half of 2024 and the first half of 2025. The company also disclosed in a corporate filing that Huffman (the CEO) sold 500,00 of his shares and that the Chief Operating Officer, Jennifer Wong, sold 514,000. Furthermore, Bloomberg interviewed Omar Abbasi, a 34-year-old software engineer in the Bay Area, who received a job offer, partly due to his unpaid work as a moderator for Reddit’s gaming communities. However, he declined the offer, citing concerns about the risk involved, drawing a parallel with Facebook’s stock stagnation post-IPO in 2012. Abbasi’s views and worries are most likely shared with many others.

CONCLUSION

In a nutshell, it is still not clear if the buzz was really worth the hype, considering that the market is showing volatile behavior. Nevertheless, it is worth noting that Reddit posted a net loss of $91 million last year, while still having more than $700 million of cumulative losses. Therefore, the company has to make some drastic changes for their situation to turn around. Furthermore, it is remarkable that this website is very community-oriented. In fact, Reddit’s most loyal users were able to buy 8% of the shares at IPO price, but users could prove tricky to monetize since there’s opposition to intrusive advertising. Hence, Reddit has a difficult ride ahead in trying to appease their tight-knit community of “redditers” and manage to make a profit.

Sources: Business Insider; Bloomberg; Financial Times

Alegra Maza