Reading Time: 5 minutes

Tariffs have always been a contentious tool in global economic policy, and former President Donald Trump’s administration relied heavily on them to reshape America’s trade relationships. Trump’s approach to tariffs was characterized by the belief that they would protect American industries, reduce the trade deficit, and pressure foreign partners into negotiating more favorable deals for the United States. However, the actual effects of these tariffs have been complex and far-reaching, influencing everything from global supply chains to consumer prices. This article explores the potential and actual impacts of Trump’s tariffs on markets and international trade, offering examples, economic analysis, and perspectives from multiple sources.

What Are Tariffs and Why Did Donald Trump Use Them?

Tariffs are taxes imposed on imported goods. By making foreign goods more expensive, tariffs are intended to encourage consumers to buy domestic alternatives. Trump saw tariffs as a tool to reduce America’s trade deficit, particularly with China, and to protect domestic industries like steel, aluminum, and technology manufacturing.

Key Examples of Trump’s Tariffs:

- In 2018, Trump imposed a 25% tariff on steel imports and a 10% tariff on aluminum.

- In the same year, the administration slapped tariffs on $250 billion worth of Chinese goods, leading China to retaliate with tariffs on American products like soybeans, cars, and airplanes.

- In 2020, Trump threatened additional tariffs on European Union exports such as wine, cheese, and aircraft parts in retaliation for EU subsidies to Airbus.

How Tariffs Affect Domestic Markets

1. Higher Costs for Consumers

While tariffs target foreign producers, the actual cost burden often falls on domestic consumers. Importers pass higher costs onto consumers, making everything from cars to electronics more expensive. A study by the Federal Reserve Bank of New York estimated that by the end of 2019, Trump’s tariffs cost the average American household about $831 per year due to higher prices.

Example: When tariffs were imposed on washing machines in 2018, prices jumped nearly 12% within months, according to research published by economists at the University of Chicago and the Federal Reserve.

2. Disruption of Supply Chains

Many U.S. industries depend on imported components and raw materials. Tariffs on Chinese technology parts, for instance, disrupted the electronics and automotive sectors, which rely heavily on Chinese factories for affordable parts. This forced companies to either raise prices or absorb losses, weakening profit margins and investment. In the long run, some firms moved production out of China, but this led to higher transition costs and inefficiencies.

Impact on International Trade

1. Retaliatory Tariffs and Trade Wars

When the U.S. imposed tariffs, trading partners retaliated with their own tariffs. China targeted American agricultural exports, including soybeans, corn, and pork, hurting U.S. farmers who relied on the Chinese market. By mid-2019, U.S. agricultural exports to China had fallen by 53% compared to 2017.

Example: The American soybean industry suffered particularly harsh consequences. Before tariffs, China imported about $12 billion worth of U.S. soybeans annually. By 2019, that number dropped to under $3 billion. The U.S. government ended up subsidizing farmers to offset their losses, costing taxpayers billions. (Source: Bloomberg, 2019)

2. Erosion of Trade Alliances

Trump’s unilateral use of tariffs alienated key allies, including the European Union, Canada, and Mexico. When Trump imposed steel and aluminum tariffs, both Canada and the EU retaliated with tariffs on iconic American products, from Harley-Davidson motorcycles to bourbon whiskey. This strained long-standing trade relationships, particularly within the World Trade Organization (WTO) framework, which is built on predictable, rules-based trade.

Effects on Financial Markets

1. Market Volatility

Trump’s tariff announcements often led to immediate stock market swings. When tariffs on China were announced in March 2018, the Dow Jones Industrial Average plunged 724 points in a single day, reflecting investor fears of a full-blown trade war disrupting global economic growth.

2. Sectoral Winners and Losers

Some sectors benefited from protectionism, particularly domestic steel producers. However, industries reliant on steel (like automotive and construction) faced rising costs, eroding their competitiveness. Agricultural stocks, particularly in soybeans and pork, plummeted due to lost export markets.

Long-Term Economic Impacts

1. Reshoring vs. Offshoring Diversification

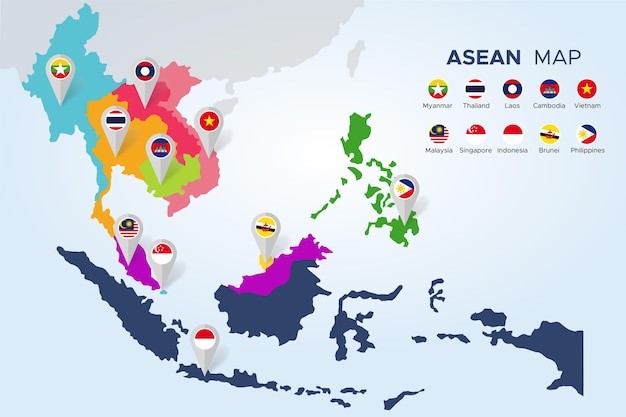

One goal of the tariffs was to bring manufacturing back to the U.S., a process called reshoring. Some companies did shift production, but many opted to diversify away from China to other low-cost countries like Vietnam, Mexico, and Thailand instead. This resulted in a fragmentation of global supply chains, increasing overall uncertainty.

2. Reduced Global Trade Growth

The uncertainty surrounding U.S. trade policy under Trump contributed to slower global trade growth. According to the World Bank, global trade growth fell from 5.4% in 2017 to just 1.1% in 2019, with tariffs playing a significant role.

Case Study: The U.S.-China Trade War

The most high-profile example of Trump’s tariff policy was the U.S.-China Trade War, which began in 2018. It involved escalating tariffs on hundreds of billions of dollars in goods on both sides. The conflict led to:

- Higher costs for American businesses and consumers.

- Reduced Chinese investment in the U.S..

- A reshaping of Asian supply chains, with companies shifting production to Southeast Asia.

Ironically, despite Trump’s goals, the U.S. trade deficit with China actually increased in some sectors, as American companies stockpiled Chinese goods before tariffs took full effect.

Trump’s tariffs were a bold attempt to reset global trade dynamics, but the unintended consequences were significant. While they did pressure China into signing Phase One of a trade deal in 2020, they also:

- Raised prices for American consumers

- Hurt American exporters through retaliation

- Increased market volatility

- Weakened global trade growth

- Undermined trust in the international trade system

As the world moves with the Trump era, policymakers face the challenge of rebuilding stable trade relationships while addressing the legitimate grievances about unfair trade practices, especially concerning China’s industrial subsidies and intellectual property violations. Whether tariffs were the right tool for this job remains hotly debated, but their lasting impact on markets and international trade is undeniable.

Sources

BBC, 2018; Peterson Institute for International Economics, 2020; Federal Reserve Bank of New York, 2019; Flaaen et al., 2019; Harvard Business Review, 2020; Congressional Research Service, 2020; CNBC, 2018; Reuters, 2018; Brookings Institution, 2020; Bloomberg, 2019; World Bank, 2020; Peterson Institute for International Economics, 2020.

Afonso Freitas

Research Editor & Writer