It is well known countries diverge in levels of development which lead us to a world full of inequalities, but did you ever wonder how we ended up in this situation?

Oded Galor argues that, even though there are factors that perpetuate inequalities, the deep-rooted factors that triggered (or not) development were related to population diversity and the geographical profile of each region. Let’s dive into his theory.

Geographical traits

Evidence of geographical differences in the world dates as far back as to when civilizations chose places like the Fertile Crescent, Mesoamerica, and the Yangtze River Valley to settle. These offered rich soils and favorable climates for the domestication of plants and animals, leading to stable food supplies and population growth. The unequal availability of domesticable species across regions meant some societies could develop agriculture more rapidly than others, creating early disparities in wealth and social organization.

Eurasia’s east-west orientation was another key factor, as it facilitated the spread of crops, technologies, and ideas across similar latitudes and climates, resulting in a more rapid and widespread agricultural advancements compared to the north-south axis of Africa and the Americas, where climate varied significantly. Furthermore, areas prone to diseases like malaria (especially in sub-Saharan Africa) which increased infant mortality rates and the sleeping disease which killed or weakened livestock and population, negatively impacted their economic trajectories compared to healthier regions. Later on, large civilizations would also choose not to settle in these regions due to the high mortality rates.

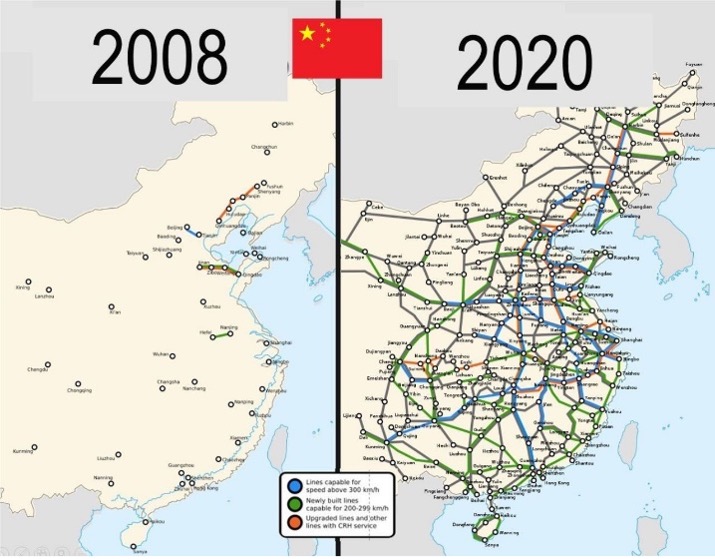

It was due to a lot of geographical traits that the European Miracle happened around the 18-19th century. Europe had proximity to the sea and navigable rivers which was advantageous for trade and many states with different languages which promoted competition and fostered economic growth while China was unified and had a uniform writing system, single language and central control. According to the hydraulic hypothesis by Karl Wittfogel, the fact that Europe depended largely on rainfall compared to China having a network of dams and canals with political centralization also fostered innovation and competition inside Europe. Other advantages of Europe were the Pyrenees, alps and Carpathian Mountains – hurdles that were natural buffers to invasion and the fractal shoreline which made it easy to defend from invaders and encouraged maritime trade. Comparably, China had mountain ranges that offered little protection from centralized imperial rule and no peninsulas apart from Korea which was independent.

Geographical roots of cultural traits

There are some cultural traits with geographical roots responsible for differences in development. For example, regions with higher return on crop cultivation would tend to be more long-term oriented and therefore invest in innovative agriculture or alternative methods even if that meant sacrificing present consumption. Also, in regions where the plough (which required massive upper body strength) was the main tool of agriculture, there was a division of labor (men would work on the fields and women would take care of the house) and a less egalitarian view on women would be passed along generations. Last but not least, areas with uniform climates would generally be more loss-averse and prepare their crops for possible harsh weather while areas with volatile climates between different regions and throughout the year would be more loss-neutral and risk a bit more while cultivating as they could just escape harsh weather by moving to a different region (they did not need to prepare their crops for hypothetical losses).

Population Diversity

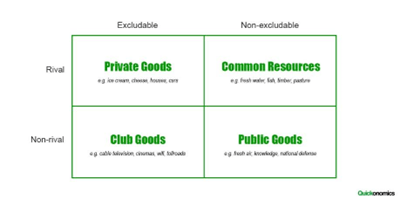

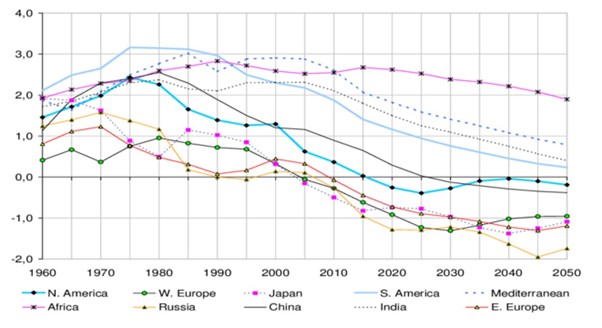

Population size and composition were considered wheels of change. Larger populations were more likely to generate greater demand for new goods, tools and practices, as well as exceptional individuals capable of inventing them, and benefited from more extensive specialization, expertise and exchange of ideas through trade. Moreover, as stated in Darwin’s natural selection, any intergenerationally transmitted trait which makes an organism better adapted to their environment, generating more resources, would survive longer, setting human capital formation as a pertinent element of growth.

Social diversity can also explain some of today’s divergences. According to the Serial Founder Effect, the further a region is from Africa the less diverse it is. This happens because populations started settling in Africa 300k years ago and, as they migrated farther away, the less they would mingle with diverse species reducing variety in civilizations. Since social diversity has a contradictory effect, as it spurs cultural cross-pollination of ideas and enhances creativity, fostering tech progress but also provokes conflict and erodes the kind of social coherence necessary for investment in public goods, an intermediate level of diversity is the sweet spot conducive for economic development. That is why Latin America with lower level of diversity and Africa with higher levels of diversity are less developed than Europe which has intermediate levels of diversity.

Institutions

Institutions and cultural traits were not what triggered development, but rather what determined the speed of it. North and South Korea are a perfect example. They were both dictatorships, but while NK had massive nationalization of private property and centralized decision-making, SK had private property protections and decentralized political and economic power, making inclusive institutions promotive of development and extractive institutions a hindrance to it.

Other example is former British colonies which had common law systems compared to Portuguese and Spanish colonies with civil law systems. Or even South Italy with a feudal order and mafia, characterized by lower prosperity, strong family ties and less trust outside family environments which issued reduced cooperation, opposite to North Italy which was a democracy with higher social mobility.

How are the inequalities Deepened?

We have stated the possible deep-rooted foundations for the inequalities we face nowadays, but what about the causes that emphasise those already existing disparities in qualities of life?

We can adopt a different outlook on this topic, by saying that inequality deepens because of a rapidly changing world. By interacting with a range of factors, including economic systems, political factors, cultural influences, rapid technological change, but also the climate crisis, urbanization and migration, as well as gender, age, origin, ethnicity, disability, sexual orientation, class and religion. Addressing these facts requires a comprehensive understanding of both historical and contemporary factors.

By delving a little bit deeper on some of these topics, we gain a better understanding of how they are undeniably associated with an inevitable distinction between people and their lifestyles.

Technological progress came about as a revolution that became shocking because of its quickness to spread and develop. The unequal access to it can lead to disparities in access to information, skills and economic opportunities. Because of the previously stated deep-rooted causes, some nations are wealthier, disproportionally benefiting new technologies, while poorer communities may lack the resources to adopt them. This may lead to a whole new range of problems, as automatic and digital technologies can displace low-skilled workers, exacerbating unemployment and wage inequality, affecting those vulnerable populations who may, once again, not have the means to transition to these new jobs. Thus, a much larger bridge to connect these nations is imperative.

When we focus on Globalization, we can easily conclude that it has facilitated the flow of goods, services, and capital across borders, undisputably benefiting some economies. That does not exempt the fact that it ultimately marginalized developing countries who may struggle to compete on equal footing with those established markets, leading to uneven economic growth. Also, global supply chain often exploits labour in developing countries, where workers may face low wages accompanied with poor working conditions, which is the case of India, Bangladesh or Kenya, where there is an increasing population of “working poor”. Both poverty and a global workforce at risk of exploitation are socially created circumstances that drive the demand for inexpensive labour, which in turn sustains the profitability of labour-intensive industries. This will perpetuate cycles of poverty and inequality within those regions, as well as wealth concentration in the hands of multinational corporations and affluent individuals, often at the expense of local economies and communities.

Many developing countries rely heavily on the export of a few commodities, leaving them volatile and dependent of commodity price cycles. Price fluctuations can lead to economic instability. When the prices are risen, the benefits often accrue to a small elite or foreign investors rather than being distributed to the broader population. This can exacerbate existing inequalities and impose limits on economic mobility for local communities. Also, some countries that are considered resource-rich experience a so called “resource curse”, that believes that these countries rely exuberantly on those resources, neglecting the other sectors, hindering sustainable and equitable growth.

Conclusion

In alignment with all that it was tackled, understanding global inequalities requires a comprehensive view that considers both historical contexts and current dynamics, revealing how deep-rooted factors continue to influence disparities in quality of life across the world, and what other factors carry on deepening it.

Sources: “ECCHR: Forced Labor in Global Supply Chains.”; “Causes of Inequality – Equality Trust.”; “Psychological Characteristics and Colonialism: Where the Deep Roots of International Inequalities Were Shaped – the Sustainable Development Watch.”; “The Resource Curse: The Political and Economic Challenges of Natural Resource Wealth”.

Laura Casanova

Teresa Catita