When Markets Look At Politics

We are used to thinking of financial markets as driven only by economic principles such as inflation, interest rate expectations, and growth forecasts. In this context, politics is background noise: unpredictable, difficult to quantify, and irrelevant to asset pricing. Yet this perception increasingly misrepresents reality.

Political developments have become central to how markets interpret risk, reprice assets, and allocate capital.

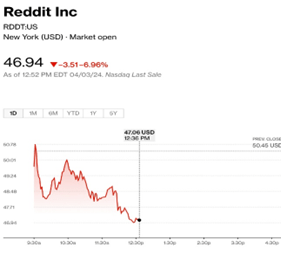

Nowadays, headlines from governments regularly trigger revaluations. Political uncertainty is growingly emerging as a source of volatility and a key determinant of sovereign borrowing costs. Every new cabinet announcement, legislative halt or budget negotiation is a signal investors have to price, quickly and with little margin for error.

The uncertainty about future government actions may have a dual effect on market prices. In rare cases, it may represent policy flexibility against shocks. But in the majority of cases, it may actually reflect growing doubts about institutional resilience and future fiscal tracks.

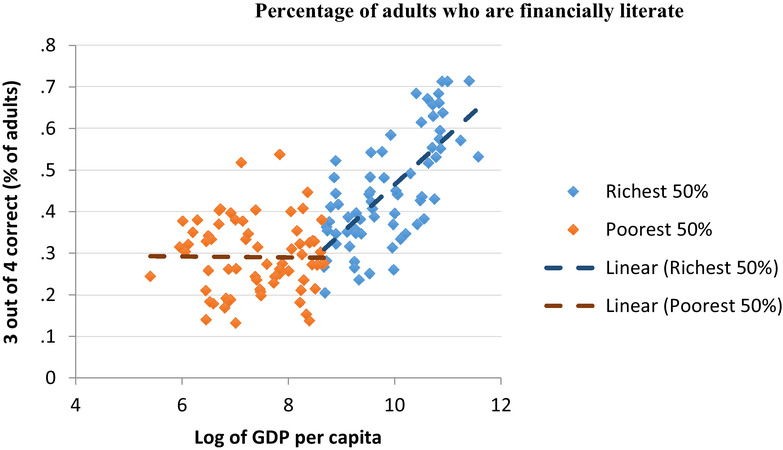

The market impact is clear: as stock prices respond to political news, political uncertainty leads to higher equity risk premium, increased asset correlation and consequently lower diversification benefits.

To better understand how political turmoil can flow into financial markets, we can have a look at the most recent case: France.

The French Distress

In October 2025, France dived into a serious political turbulence after the resignation of Prime Minister Sébastien Lecornu just one day after announcing his cabinet. It’s the collapse of the fifth prime minister in just two years, a statistic that points out not just instability but a deeper fracture in the French political system.

Public surveys reveal despair, pessimism and distrust as the prevailing feelings in French citizens. Worrying symptoms representing the profound current democratic crisis, not even two years ahead of the next presidential election.

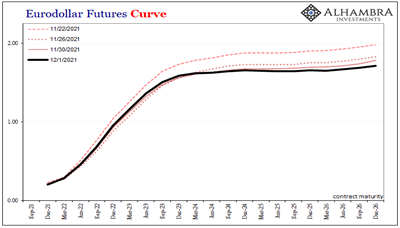

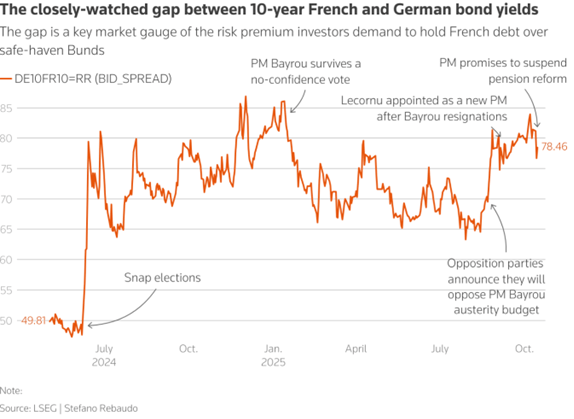

Financial markets, never known for patience but for how quickly they react, are clearly reflecting investors’ sentiment. Not surprisingly, French equity indices dropped, and bond markets did not do differently. For instance, yields on the 10-year French government bonds skyrocketed by 7-8 basis points, reaching around 3.58%. The spread between French and German bond yields broadens as investors demand a premium for holding what they see as riskier sovereign debt.

Source: LSEG via Reuters.

The reason for this reaction? The answer is not that straightforward. No single event triggers the repricing by itself, but the clear loss of confidence in France’s fiscal policies plays an unequivocal role. The situation in France is getting complicated, both politically and economically.

The general feeling speaks loud: France looks unable to find its way out of this malaise.

Shifting Benchmarks

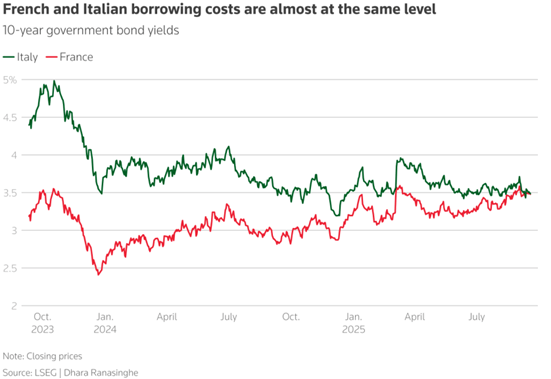

Historically, France was perceived as relatively safe within the Euro area bond markets. Italian bonds, instead, have been telling a different story so far. Yet, trends are changing.

As French borrowing costs have risen, Italian yields have followed the opposite direction. This shows how perceptions around France, once considered a core market, and Italy, long seen as one of the weakest ones instead, have radically changed. Investors are concerned that France will not be able to improve its fiscal position due to its political instability, thus pushing up its bond yields. Different story for Italy, where relative political stability and downward debt forecast have caused its bond yields to decrease.

But be careful. For some, the narrowing of the French-Italian bond spread has more to do with French fiscal and political distress than an improvement in Italy’s market.

Italy has been afflicted by chronic problems that will take a long time to fix. We are still talking about the euro zone’s second-largest debt as a percentage of GDP after Greece, with a growth of the economy being obstructed by a concerning falling population and low female employment.

Still, the convergence of French and Italian bond yields serves as a striking illustration of the implications of political stability and credible budgeting on investors’ confidence.

Indeed, global investors nowadays look at governance quality in advanced economies pretty much as economic principles to adjust their required returns.

Impact On Growth And Market Confidence

Beyond market volatility, political instability carries important long-term economic costs. Empirical research on advanced economies has demonstrated that an uncertain politics can cause delayed investment decisions, hard policy execution, and undermined growth prospects. In fewer words, high levels of political instability can overall cause worse economic output.

The reasons are pretty intuitive: when governments are fragile or policy direction is unclear, businesses and consumers lose confidence. Private sectors struggle to create expectations, while public institutions turn less effective in providing structural reforms.

But as fragmented governments are not able to enact reform, public finances deteriorate. In France, the continuous change in leadership has paralysed the adoption of a new fiscal regime, delaying important decisions on expenditure and taxation. This creates a dangerous loop: as fiscal negligence decreases investor confidence, sovereign borrowing costs increase, which displace public spending, which in turn further constrains the ability to enact future reforms.

France, for instance, has gone through five prime ministers in just two years, its national debt exceeding €3 trillion, and it seems unable to create a credible path towards fiscal balance.

Source: Eurostat.

Globally, the political instability of an advanced economy as France can have both negative and positive spillover effects on other regions as well. On one hand, investors may require higher risk premiums also from other countries perceived as politically vulnerable. On the other hand, such instability may cause a flight-to-quality flows, as capital would flow towards safer bonds such as Germany Bunds or U.S. Treasuries.

However, the coincident fiscal crises in multiple large economies, might result in a broader reallocation of global capital away from equities and emerging markets, thus potentially threatening global growth.

Institutions such as the IMF and OECD have pointed out how political stability and consistent fiscal policies are not only priorities at the domestic level, but also the foundations of international market confidence and macroeconomic resilience.

Conclusion

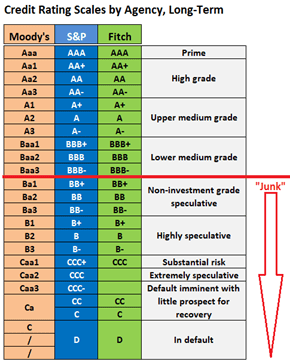

What France is going through right now is not just a domestic drama. We are using this case as an understanding of what can be the costs of institutional fragility in a period of high debt and fiscal uncertainty. When governments and their reforms falter, consequences can be urgent: higher borrowing costs, downgraded credit ratings, eroded currencies, and constrained growth.

If investors would once see political risk as background noise, now they price it in their models and we need to discuss it. The bond market has become a criterion of credibility, which rewards discipline and punishes obstructions.

The message to policymakers is clear: good governance is capital. Stability, transparency, and consistency are no more mere abstract democratic values, but economic assets bringing yield. We are still in a post-pandemic context with high interest rates and insecurities, and policy incoherence is no longer tolerated.

Preserving market trust is vital. Governments must now handle both budgets and expectations. Credibility can be the cheapest form of stimulus for those countries facing high debt and structural change. And as France is showing, once lost, it becomes the most expensive asset to restore.

Sources: Reuters; Euronews; Financial Times; Fitch Ratings; Eurostat; LSEG via Reuters; IMF; OECD; ECB; Political Uncertainty and Risk Premia, by Lubos Pastor & Pietro Veronesi; European Journal of Political Economy; Political Instability and Economic Growth: Causation and Transmission, by Maximilian W. Dirks & Torsten Schmidt.

Rebecca Fratello

Writer